5 Common concerns when hiring in LATAM

5 Common concerns when hiring in LATAM

Businesses are increasingly looking to expand their talent pools globally, and Latin America (LATAM) has become a key region for recruiting skilled professionals. Despite this, many concerns often arise when considering LATAM talent, which can deter companies from tapping into this rich pool of talent. In this blog, we will address five common concerns about hiring in LATAM, provide insights into the realities of these issues, and demonstrate how partnering with Top Latin Talent can help companies navigate these challenges effectively.

1. Navigating diverse labor laws and tax regulations in LATAM

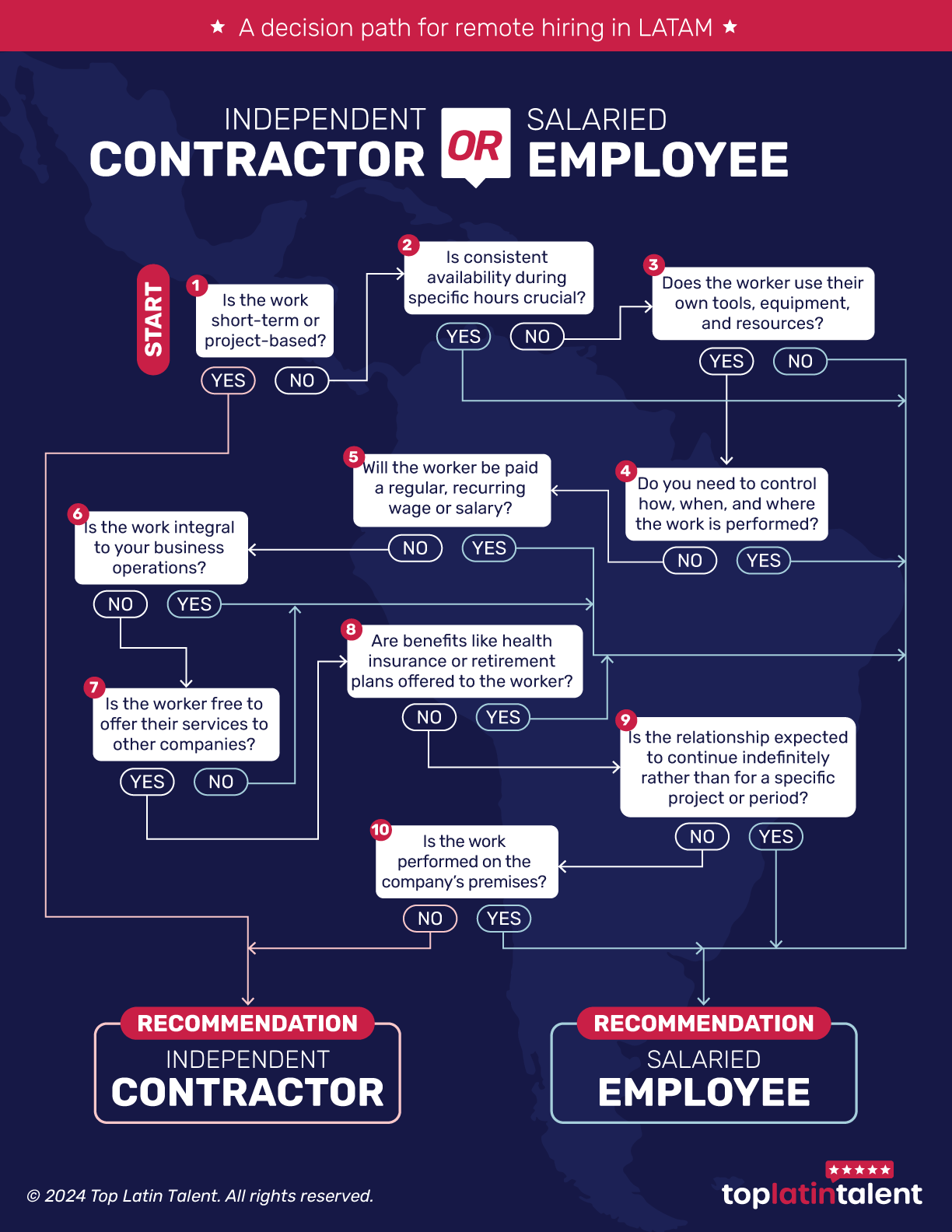

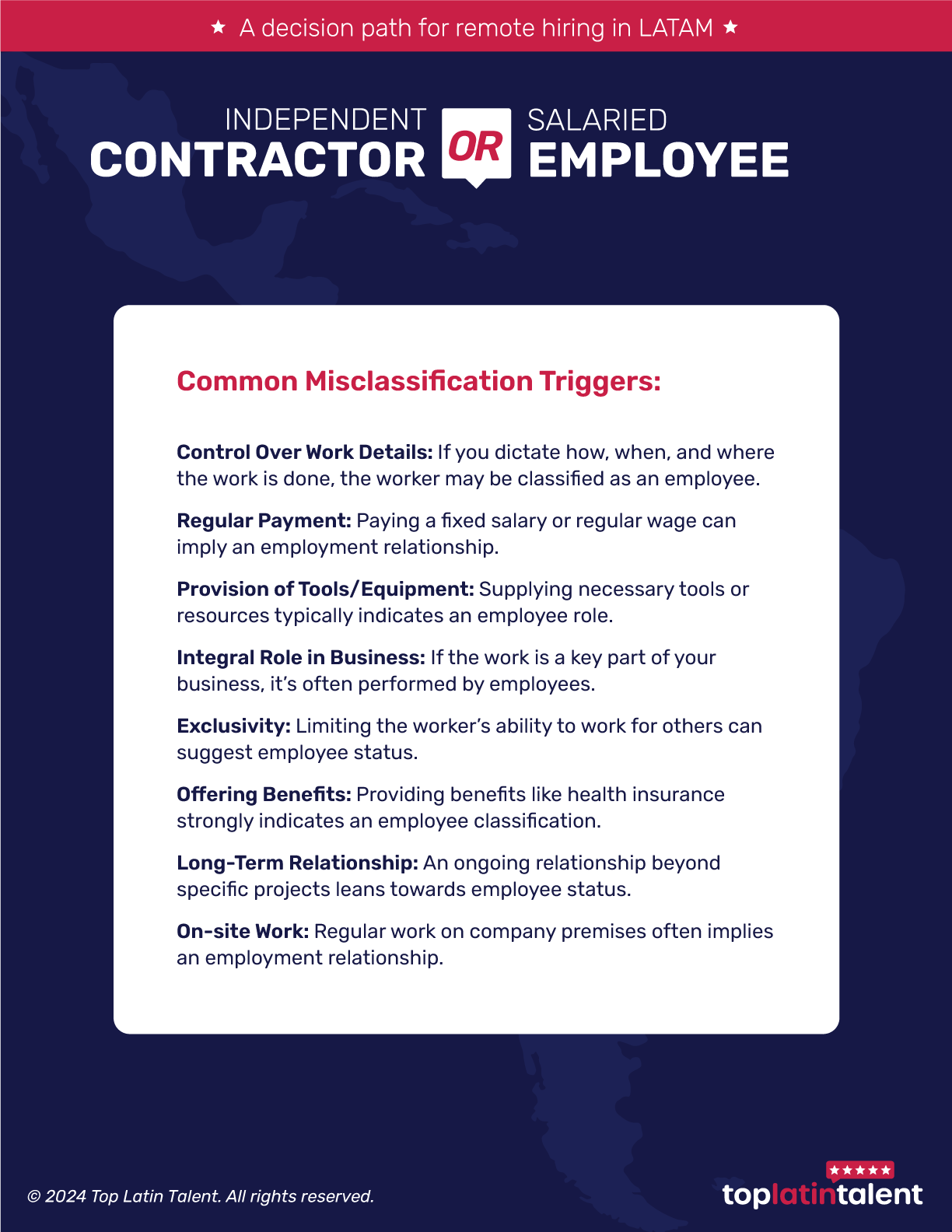

When considering hiring in LATAM, one of the main concerns is the complexity of local labor laws and tax regulations. Each country in LATAM has its own legal framework, which can be overwhelming for companies unfamiliar with these systems. The fear of non-compliance and potential legal repercussions is a significant concern, and for good reason—errors in legal matters can result in costly fines and administrative burdens.

While it’s true that LATAM countries have diverse legal frameworks, the complexity can be managed with the right resources and tools. Platforms like Deel and Oyster have simplified the international hiring process by streamlining compliance. These platforms offer a comprehensive range of services that handle local labor laws, tax regulations, and contracts customized to each country’s unique requirements.

By utilizing these platforms, businesses can remain compliant with local regulations without needing to be experts in each jurisdiction. Deel and Oyster manage the legal complexities of hiring in LATAM, allowing companies to focus on integrating and utilizing their new talent effectively. Additionally, consulting with legal experts specializing in international labor laws can reduce risks and provide tailored guidance.

2. Doubts about the quality of education and skills of LATAM professionals

Many companies in North America and Europe wonder whether professionals from Latin America have the necessary education and skills to meet global standards. They are concerned that universities in Latin America may not offer the same level of education as those in North America or Europe, which could affect the quality of candidates from the region. This perception can make them hesitant to consider candidates from Latin America.

Reality: Latin America is home to numerous prestigious universities and technical institutes that produce highly skilled professionals. Institutions such as the University of São Paulo (Brazil), Tecnológico de Monterrey (Mexico), and the University of Buenos Aires (Argentina) are renowned for their rigorous academic programs and strong emphasis on practical experience. Many professionals from Latin America have received top-notch education and gained substantial experience working with globally recognized companies. For example, they often collaborate with major international tech giants, leading global firms, and innovative startups. This exposure to global business practices and cutting-edge technology further enhances their skills and ensures they meet the high standards expected in international markets.

Solution: Partnering with Top Latin Talent can help businesses effectively navigate this landscape. Our rigorous screening process ensures that candidates possess verified skills and qualifications. We assess educational backgrounds, practical experience, and technical competencies to provide you with access to top-tier talent. Furthermore, we consider candidates’ experience with renowned global companies, ensuring they bring valuable insights and industry best practices to your organization. By conducting thorough evaluations, we ensure that the candidates you hire are highly skilled, aligned with your specific needs, and accustomed to working in diverse and dynamic environments.

3. Difficulties in integrating LATAM talent with American teams

Integrating Latin American (LATAM) talent into American teams can be challenging, especially regarding communication, work culture, and project management. Differences in work practices, cultural norms, and procedures can create friction and affect team dynamics. Smooth integration is crucial for maintaining productivity and collaboration.

Reality: Integration challenges are valid, but not impossible. Modern technology provides powerful tools to bridge gaps between geographically dispersed teams. Platforms like Slack and Microsoft Teams enable seamless communication, allowing teams to stay connected regardless of location. Trello and Asana streamline project management, ensuring organized tasks and met deadlines. Tools like Notion and Miro provide interactive spaces for collaborative work and brainstorming that foster creativity and effective planning.

Solution: Embracing these collaboration tools can significantly ease the integration process. Implementing regular communication practices and setting clear expectations can help align teams and foster a collaborative environment. Investing in cultural training for team members can improve understanding and empathy, enhancing overall team cohesion. Top Latin Talent can facilitate smooth integration by providing ongoing support and guidance throughout the process, ensuring that LATAM talent is seamlessly integrated into your teams.

4. Concerns about the English proficiency of LATAM professionals affecting communication

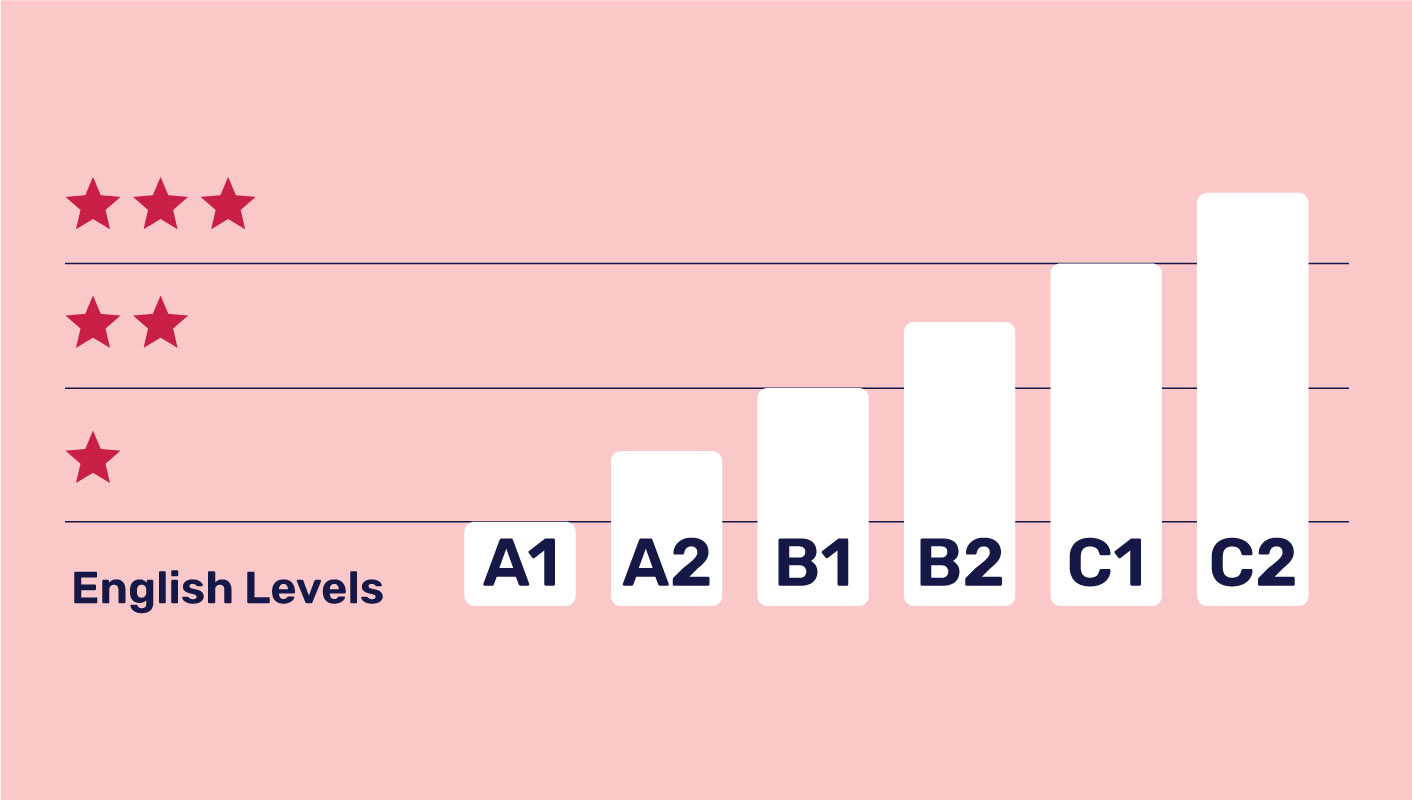

English proficiency is a significant consideration when hiring international talent, especially for positions that involve regular communication with global teams. Some companies are concerned that professionals from Latin America (LATAM) may not have the English skills to effectively manage international projects, potentially leading to communication barriers and impacting project success.

Reality: many professionals from LATAM, particularly in the tech industry, have strong English skills due to the global nature of their work and the emphasis placed on language skills in higher education. Numerous universities in LATAM offer courses in English, and professionals often work in environments where English is the primary language of communication. This exposure helps them develop strong language skills essential for international collaboration.

Solution: At Top Latin Talent, we prioritize English proficiency as part of our recruitment process. We conduct thorough assessments to ensure candidates have the necessary language skills to communicate effectively and collaborate on international projects. By screening for strong English proficiency, we help businesses avoid potential language barriers and ensure that new hires can seamlessly integrate into their teams. Our focus on language skills ensures that LATAM professionals can contribute effectively to your projects and communicate clearly with global stakeholders.

5. Challenges in coordinating work across different time zones

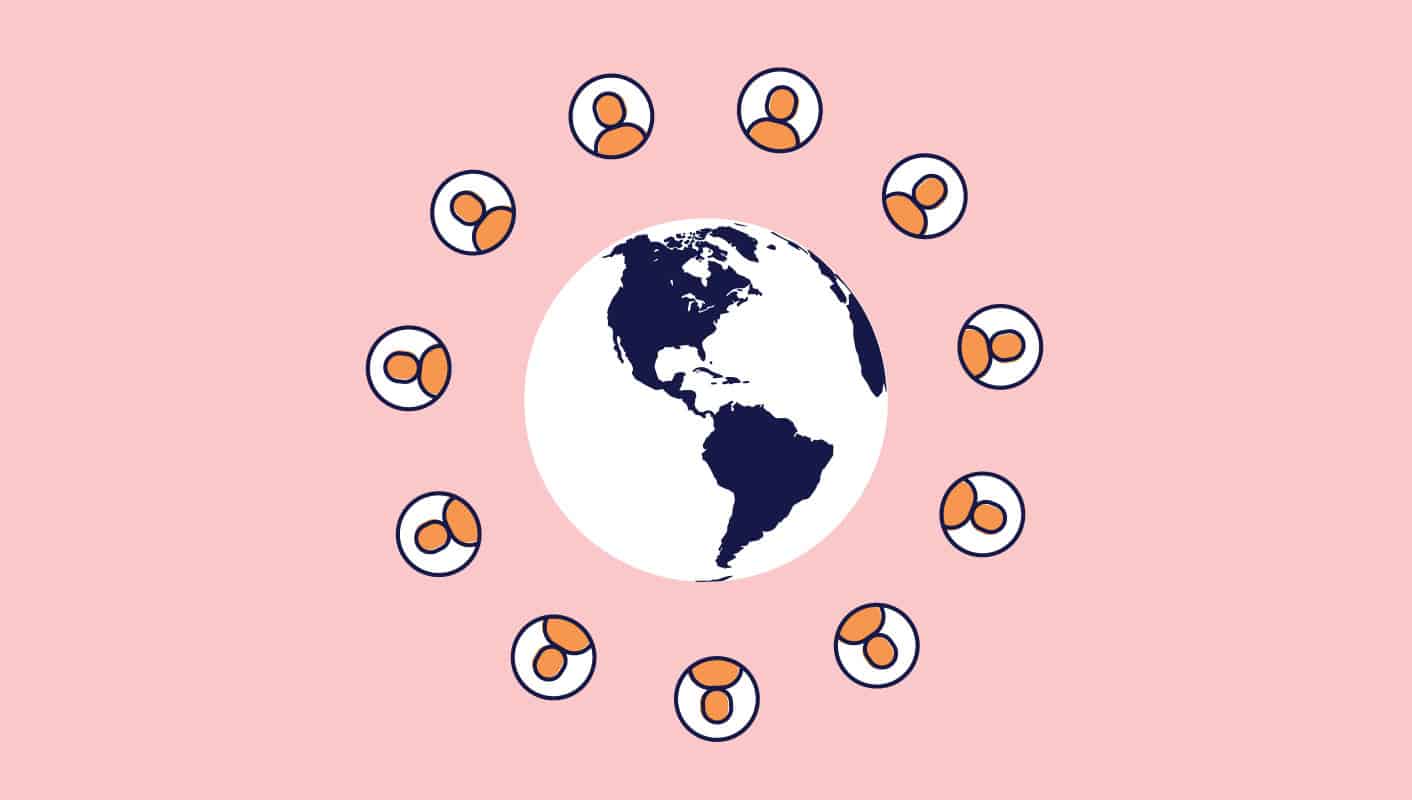

Time zone differences can create challenges for real-time collaboration and project management. Companies are concerned that coordinating work across different time zones might lead to delays, inefficiencies, and difficulty maintaining productivity. This concern is particularly relevant for teams that require synchronous communication and collaboration.

Reality: LATAM generally shares time zones that are only 1-3 hours different from major U.S. cities. This proximity is advantageous for real-time collaboration. The close time zone alignment allows for overlapping work hours, making synchronous communication and collaboration feasible. Additionally, flexible work hours can further align schedules, enhancing productivity and minimizing potential disruptions.

Solution: To effectively manage time zone differences, businesses can implement flexible working arrangements and use scheduling tools to coordinate meetings and deadlines. By setting clear expectations and establishing overlapping work hours, teams can maintain effective communication and collaboration despite geographical distances. The close time zone proximity makes it easier for LATAM talent to integrate into U.S. teams, ensuring smooth operations and efficient project management.

If you’re considering expanding your team by hiring from LATAM, Top Latin Talent is here to assist you. Our expertise in connecting U.S. and Canadian companies with highly qualified LATAM tech professionals ensures that you can overcome common concerns with confidence. Schedule a commitment-free meeting today with us to learn more!